Paycheck calculator with new w4

You will find instructions on how to increase or decrease that tax withholding amount. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs.

A New Form W 4 For 2020 Alloy Silverstein

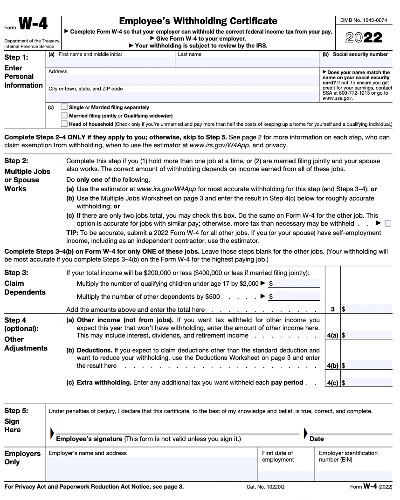

Subtract the value of Withholding Allowances claimed for 2022 this is 4300 multiplied by Withholding Allowances claimed on the employees W-4.

. How Your Paycheck Works. On a side note if you use the withholding calculator to make alterations to the amount of your paycheck thats. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

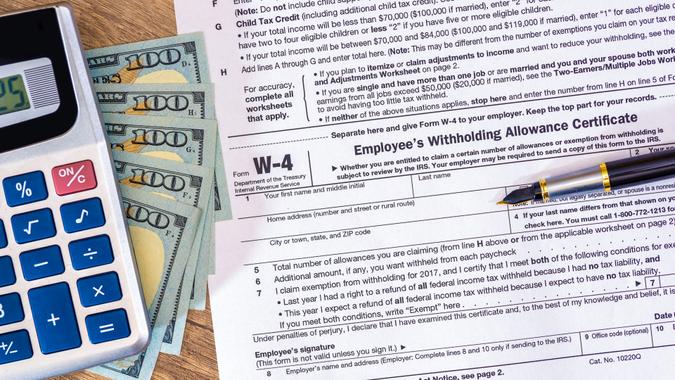

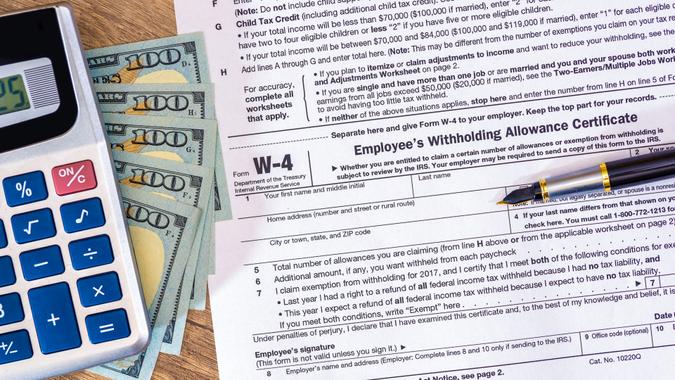

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This number is the gross pay per pay period. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate Ask your employer if they use an automated system to submit Form W-4 Submit or give Form W-4 to your employer.

Subtract any deductions and payroll taxes from the gross pay to get net pay. We use the most recent and accurate information. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Salary and Hourly Calculators Salary Calculator Determine your take-home pay or net pay for salaried employees. Use our W-4 calculator. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

All Services Backed by Tax Guarantee. Important note on the salary paycheck calculator. Calculate your annual tax by the IRS provided tables.

Switch to salary Select Your State. The PaycheckCity salary calculator will do the calculating for you. Calculate my W-4 Your W-4 calculator checklist.

Ad Create professional looking paystubs. Or keep the same amount. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

Dont want to calculate this by hand. To change your tax withholding amount. The calculator on this page is provided through the ADP.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Switch to New Jersey hourly calculator. When done create the W-4 and the result of that W-4 will be based.

Figure out which withholdings work best for you with our W-4 tax withholding calculator. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Get the Paycheck Tools your competitors are already using - Start Now.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. In a few easy steps you can create your own paystubs and have them sent to your email. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Five to 10 minutes to complete all the questions. Other paycheck deductions are not taken into. Use your estimate to change your tax withholding amount on Form W-4.

Ad Payroll So Easy You Can Set It Up Run It Yourself. This paycheck calculator will help you determine how much your additional withholding should be. Employees Withholding Allowance Certificate.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Another way to manipulate the size of your paycheck - and save on taxes in the process - is to increase your contributions to employer-sponsored retirement accounts like a 401k or 403b. Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your selected pay period.

W 4 Form Basics Changes How To Fill One Out

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

W 4 Form Guide How To Change Your Tax Outcome Taxact Blog

Federal And State W 4 Rules

W4 Tax Form 2022 With Calculations W 4 Tax Form How To Fill Out W4 Tax Form 2022 Youtube

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

How To Fill Out A W 4 A Complete Guide Gobankingrates

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

2020 W 4 Updated

W 4 Form What It Is How To Fill It Out Nerdwallet

Irs Releases Updated Withholding Calculator And 2018 Form W 4 Abacus Group Blog

What Is A W 4 Form How It Works Helping Your Employees Complete It

A New Form W 4 For 2020 Alloy Silverstein

Paycheck Tax Withholding Calculator For W 4 Tax Planning